A recursive model for space sector growth and investment

As a computer scientist and electrical engineer, I love the concepts of recursion and feedback loops. If a simple system has an input, an output, and some process in the middle, what happens when you plug the output back into the input? Perpetual motion? A black hole? The birth of the universe?

Sadly, I’m yet to see any of these. But it is fascinating that feedback loops are everywhere. We use feedback loops in finance when we compound interest rates to model exponential savings and investments. Internal combustion engines rely on a feedback loop of energy to continually transform fuel into motion.

Feedback loops need a catalyst to start the process. In computing, this phenomenon is called ‘bootstrapping’ (it comes from the phrase, “to pull oneself up by their bootstraps”). A motorbike might have a kick-start lever so the rider can manually turn the motor to start the combustion cycle, or it will have an electric motor that does the same job when you switch the ignition.

A business is also a feedback loop. A new business requires some kind of initial starting resource, usually capital, and you use that capital to do work for someone that pays the business money. A good business is one that brings in more money than it consumed in the first place. Bad business is one that returns less money than it consumes in the first place. A sustainable business is one that generates at least as much capital as it costs to run. Usually, it takes time to refine the business model (note: a business model describes a recursive cycle of, preferably, compounding capital) so that it becomes more efficient, morphing from a financial black hole (there it is!) to, at least, financial sustainability.

We can design feedback loops that are able to amplify, dampen, or perpetuate some kind of action that a system performs over time.

Simple causal reasoning about a feedback system is difficult because the first system influences the second and second system influences the first, leading to a circular argument. This makes reasoning based upon cause and effect tricky, and it is necessary to analyze the system as a whole.

– Karl Johan Åström and Richard M. Murray, Feedback Systems: An Introduction for Scientists and Engineers

Amplifying a Space Economy

I have an ambitious life mission to help transition the global economy into a space economy. This isn’t as simple as starting a single business, so I’ve built Moonshot to help start numerous valuable businesses — an ecosystem — to catalyse this.

It’s common to hear talk about accelerator programs, venture funds, startup hubs and communities — all key components of an innovation ecosystem. A lot of buzzwords and terms. The problem is that we often talk about these in isolation from one another and it can usually be more about marketing and theatrics than anything else. A government might build an innovation hub, and it might attract a community, but without an actual framework to help people collaborate together in effective ways — founders, investors, established industry, universities and governments— nothing much will happen. “Build It and They Will Come” is rarely an effective strategy.

We need to design the system as a whole, which isn’t as complex as it seems.

Keep It Simple, Stupid

You need an ecosystem to grow an ecosystem, and if you don’t already have an ecosystem, the only thing you can do is grow one.

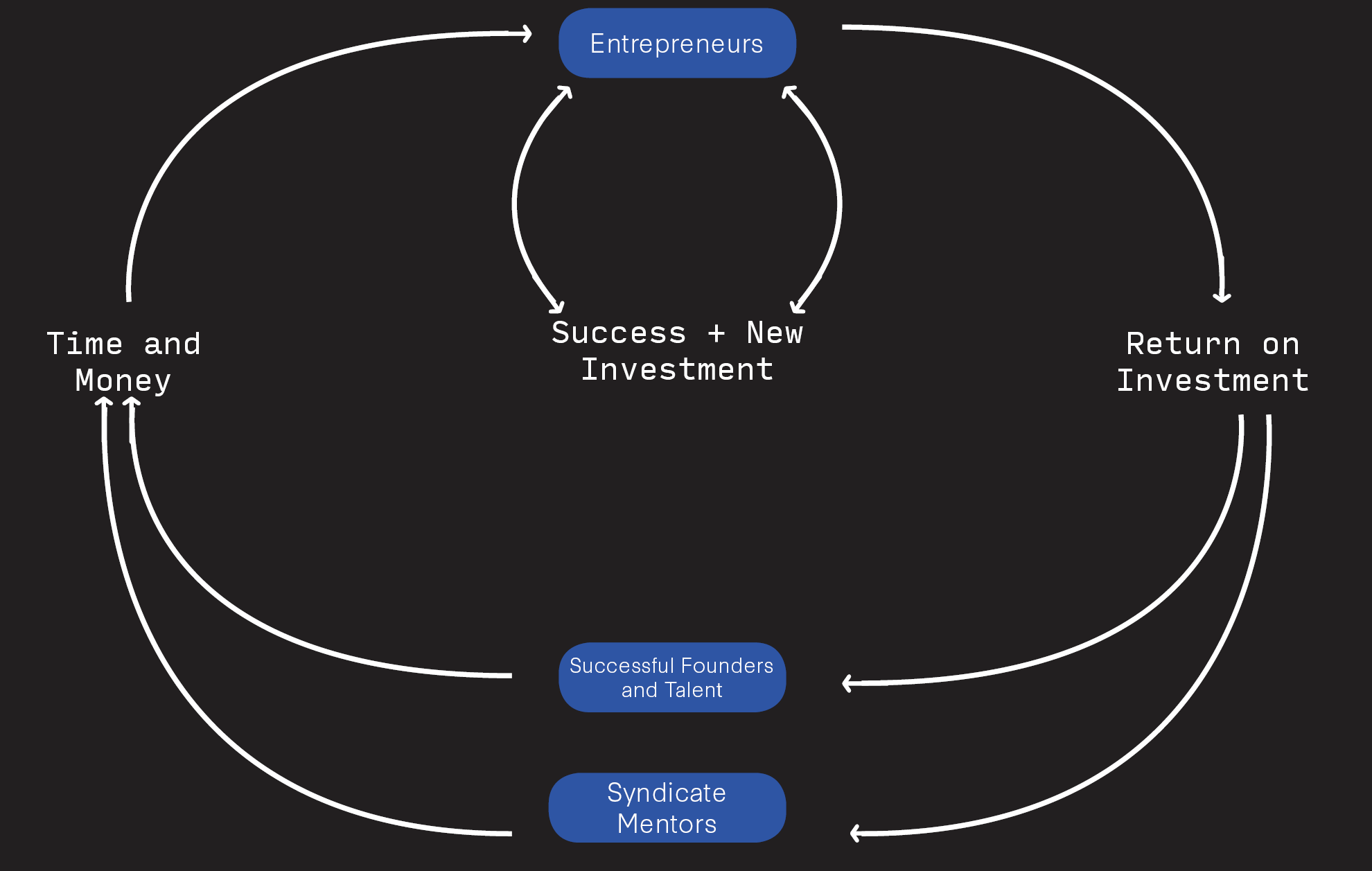

Above is Moonshot’s basic model for space ecosystem growth. It’s simple and all-encompassing. The value and size of the network the system is growing starts small at first and grows larger over time, as the flywheel gains momentum. It takes a collection of different people and aligns their goals to put them to work in a way that everyone benefits. Importantly, the system grows because it compounds over time, and as long as it’s maintained it will grow exponentially.

Let’s see how our model works:

Ingredients:

- Capable founders with innovative space-enabled business models

- Space and other business experts with money to invest

Method:

- Experts invest time and money in capable founders and startups

- The startups achieve success more easily because of easier access to rare key resources (capital and expertise)

- As the business becomes successful, the investors win while the founders become experts with money, and return to (1)

Initially, we need a small and diverse pool of high-quality mentors and sophisticated investors to catalyse the process — this is what I’m building now by assembling an investment and mentor syndicate. They provide early startups with the rare resources they need to be successful — capital, mentorship, introductions and sometimes labour. As the businesses achieve success and the investments mature, the founders and team members become expert mentors and investors themselves (in fact, some of our investors are already successful founders), closing the loop and creating a system of perpetually growing resources to create more capable founders, talent, and businesses. That’s how you grow an ecosystem.

Importantly, our mentors don’t need to contribute much capital to the syndicate to kickstart the system. In our case, it’s $5k AUD (~$3.3k USD at the time of publication) per annual cohort. Our aims are to produce startups that are sophisticated enough that they can either scale financially sustainable businesses or entice further investment (our syndicate members get first right of refusal and we maintain relationships with larger VC firms) and to build a community of supportive expert angel investors.

For 2020 we’re raising a small $200k syndicate fund of~40 investors, to invest in the 3–5 space-enabled startups that will participate in our next investment space accelerator. This syndicate is the core of the space ecosystem we’re building together, so if you’re a part of the Moonshot network and I haven’t invited you yet, please do get in touch.

We’re on the verge of a Cambrian explosion of new opportunity, so join me if you’d like to be a part of it.

Ad astra!

Troy McCann

During university, where he studied computer science and electrical engineering, Troy mixed his passions for technology and entrepreneurship through multiple engineering-heavy businesses. Using his experiences in commercialising deep research and the space industry, Troy began to develop a framework for supporting the growth of commercial solutions to humanity’s most difficult challenges while assembling a community around it, forming the basis for Moonshot.

Troy was ranked the 4th most influential new space business leader of the industry in the NewSpace People Global Ranking Report for 2019.

Comments are closed.